Californium

Between 20 and 27 million dollars per gram: Californium 252 is the most expensive metal in the world! It is also the heaviest chemical element on Earth.

When transformed, we use it as a neutron starting source in the nuclear industry and we also test in the treatment of certain cancers.

Two major nuclear groups supply the demand for californium-252, namely the Research Institute of Atomic Reactors (RIAR) in Russia and the Oak Ridge National Laboratory (ORNL) in the United States.

Its rarity and low number of buyers make californium one of the riskiest but most profitable investments for major investors.

Gold

For thousands of years and all on all continents, gold has been the symbol of wealth, power and domination.

At the end of 2010, experts said that between 145,000 and 160,000 tons of gold have been extracted since the beginning of humanity. According to various estimations, 50,000 tons of gold still remain beneath our feet. With an annual demand of 4800 tonnes, the world stock will be depleted in less than 20 years.

Used in art, gastronomy, crafts, electronics and medicine, gold is one of the safest and most profitable investments on the market.

In 2000, one ounce (Oz) of gold (31g) was worth $272.75. On May 1st 2019, its value was $1281.99.

Copper

Because of its rather easy extraction process, it was one of the first metals used by mankind. Various objects from 9000 BC have been discovered. We mainly use copper in cabling and in various heating or cooling appliances due to its ability to conduct electricity.

Investors have several ways to benefit from copper. Before 1982, some people were even melting pennies because the price of the metal was higher than the face value of the coin.

It’s possible to trade copper forward contracts, each contract accounting for 25,000 pounds of copper. We can find it on the New York Mercantile Exchange and the London Metal Exchange.

You can also participate in exchange-traded funds that deal with this particular metal. These funds may invest in future contracts or in some shares of metal sellers.

Iridium

We use iridium primarily in glass production or in certain data storage technologies. Its industrial use defines its price. It’s one of the rarest metals in the world and due to its relatively low volume on the market (compared to other industrial metals such as aluminium), its price is very unstable. It fluctuates in accordance with the changes in production, demand, speculation and hoarding of metal. But unlike gold, it is not used as a hedge against inflation.

Lithium

Pure lithium is a soft, silver-grey metal that tarnishes and oxidizes very quickly when exposed to air and water, turning dark grey to anthracite and black. It is the lightest solid element.

We use lithium in the glass industry, to produce rechargeable and high-voltage batteries or special lubricants, for metallurgy, in rubber and thermoplastic industries, fine chemicals, alloy production, etc.

China, Australia, Chile and Argentina are the main producers of lithium.

We can find this element everywhere on Earth (even in living organisms) but in minute quantities, which makes it unusable. Only the lithium found in some granites can be commercially exploitable. Therefore it is quite rare. With the explosion of the electric car market (Tesla for example) and the many ongoing projects (Yandex, Google…), any rise in demand can really increase the price of the metal on the world market.

There are two ways to invest in this metal:

- Directly buy shares of companies involved in lithium mining or in the production of lithium-ion batteries.

- Invest in funds that invest in companies of this type.

The return on your investment will depend on the ongoing popularity of mobile devices and the growing popularity of electric cars. All these devices require lithium-ion batteries and, as a result, demand for this metal will skyrocket.

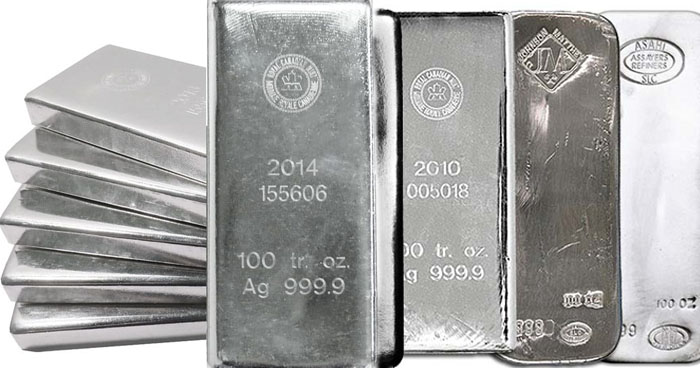

Silver

With more or less the same uses as gold, we also use silver as a currency of exchange. The ancient Egyptians and Greeks, the Babylonians and the Roman Empire were already using it as a currency. It continued throughout medieval Europe.

Compared to gold, the price of silver is much more volatile. The advantages of investing in silver are:

- Its price: much cheaper to buy than gold

- It’s a store of value

- It’s easier to sell than gold

- Silver stocks are running out unlike its demand (new technologies = new technological applications of silver)

There are several ways to invest in silver:

- Purchase silver bars and coins via trade shows and even with online bullion traders. These bars and coins are sufficiently valuable to make the storage costs worthwhile.

- Purchase ownership certificates without having to physically transfer the metal.

- Purchase of forward contracts in the COMEX. The Commodity Exchange is a division of the New York Mercantile Exchange.

- Purchase shares of mining companies, which generally exploit several types of metals.

Come and check our website Millenium State!